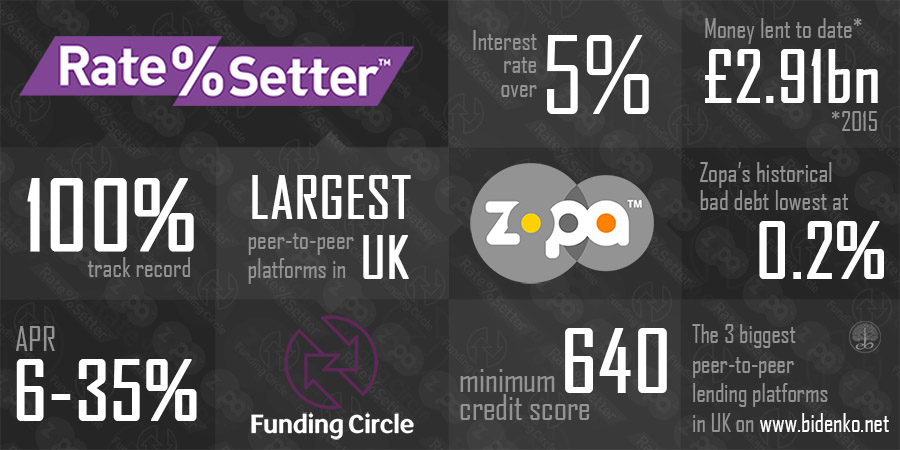

The 3 biggest UK peer-to-peer lending platforms: Zopa, RateSetter and Funding Circle

Tired of the low interest rates that savings or cash ISA accounts provide? Are you looking for an option that could at the least double the interest rate that is offered on the market by standard banks? If so, it may be worth looking at peer-to-peer lending as a healthy alternative way to make the most of your cash.

To help give a better understanding of the figures referred to in this article, ‘estimated returns’ relate to the annual estimated returns after fees and bad debts (before tax).

RateSetter: 100% track record supported by strong Provision Fund

RateSetter claim to be the largest P2P lender in the UK and offer lenders four different markets to invest to - varying in investment terms from one month to five years.

RateSetter claim to be the largest P2P lender in the UK and offer lenders four different markets to invest to - varying in investment terms from one month to five years.

RateSetter has stated that since 2010 its investors have not lost a single penny thanks to their Provision Fund and its 100% track record. Needless to say, when it comes to finance past performance does not guarantee future success and investors must bear in mind that their money is not covered by the FSCS compensation scheme.

With RateSetter you can set your own interest rate for each of your investments – called an ‘order’. For example, the actual rate is set at 5%. But if you are not in a hurry and want a better rate, you can simply just set up higher rate, say 5.3% instead of 5%.

Setting a higher rate means you often have to be patient to wait for your order to be taken up and activated. On the other hand if you are in a hurry to invest; you can set up an order at a lower rate of say 4.9% instead of 5%.

| Key point | Description |

|---|---|

| Estimated return | in range from 3% to 6% (after fees and bad debts) |

| Investment terms: | From one month to five years |

| Fee | £0 |

| Min/max lent amount | £10/unlimited |

| Loan amount (individuals in the UK) | £1,000 to £25,000 |

| Loan amount (businesses in the UK) | £25,000 to £300k |

| Lenders | over 60,000 (active) |

| Money lent to date | £2.3bn |

| Provision fund | Yes (£16.3m and grows daily) |

Interesting facts

RateSetter won the Moneywise Most Trusted Alternative Financial Provider Award 2013.

Get £100 cashback bonus from RateSetter

RateSetter’s cashback bonus increased in 2017 to £100. This bonus is ready for new customers that invest over £5000 for at least one year. Apply for your £100 bonus now

Advantages

| You can make very short-term investments (as little as one month) |

| Minimum lending amount is £10 |

| You can set your own interest rate |

| At the end of an investment term you can automatically reinvest or can withdraw as much as you like |

| No lender fee applies< |

Disadvantages

| Debit card transfers of less than £1,000 incur a £1.50 bank fee (the first three debit card transfers are free) |

| Savings are not protected by the FSCS compensation scheme |

Zopa: the longest running P2P lending provider in UK

Founded in 2005, Zopa is the longest running peer-to-peer lending provider in UK. Currently boasting over 51,000 active lenders, it is also one of the biggest on the market. Making it more attractive to many, since 2013 Zopa has offered ‘Safeguard’ cover. Safeguard covers expected losses arising from borrowers who default on their loans. Zopa state that since the launch of Safeguard, all claims on loans covered have been paid. They do, however, add the caveat that there is no guarantee that this will always be the case.

Founded in 2005, Zopa is the longest running peer-to-peer lending provider in UK. Currently boasting over 51,000 active lenders, it is also one of the biggest on the market. Making it more attractive to many, since 2013 Zopa has offered ‘Safeguard’ cover. Safeguard covers expected losses arising from borrowers who default on their loans. Zopa state that since the launch of Safeguard, all claims on loans covered have been paid. They do, however, add the caveat that there is no guarantee that this will always be the case.

With Zopa investments are automatically spread across multiple ‘reliable’ borrowers (based in UK), to diversify the risk. Borrowers are categorised on a credit risk scale ranging from A* to C.

| Key point | Description |

|---|---|

| Estimated return | 4% (Zopa Core), 4.6% (Zopa Plus) |

| Investment terms: | up to 5 years |

| Fee | 1% each year of the loan; withdrawals free |

| Min/max lent amount | £1000/unlimited (up from £10 in June 2017 for Zopa Classic) |

| Loan amount (individuals in the UK) | £1,000 to £25,000 |

| Loan amount (businesses in the UK) | None |

| Lenders | over 76,000 (active) |

| Money lent to date | £2.95bn |

| Provision fund | No (for Zopa Core & Zopa Plus) |

Interesting facts

Zopa is operating a waiting list for new customers, with a waiting time of around a month to join.

Probably thanks to high quality credit checks on loan applicants, Zopa keeps its default rate at the lowest of all its P2P companies. Since 2010, its historical bad debt stands at 0.21%.

Get a £50 cashback bonus from Zopa

ZOPA is offering £50 cashback bonus for anyone that takes or lends a loan of over £2,000 and is registered through Zopa's partner. Apply for your £50 bonus now.

Advantages

| Longest running peer-to-peer provider in UK |

| Minimized risk thanks to Safeguard fund and automatic diversification |

| Minimum lent amount is £10 |

| For immediate access to money you can sell your loans to other lenders |

| Zopa has the lowest rate of bad debts of the three main providers |

Disadvantages

| Relatively low interest rate for long fixed-term locked money |

| Additional 1% fee charge on your capital if you sell your loan(s) |

| Savings are not protected by the FSCS compensation scheme |

Funding Circle: lend money to all type of businesses

Funding Circle focuses on lending to all type of businesses, rather than individuals. Established in 2010, to date it has granted loans of almost £902 million.

Funding Circle focuses on lending to all type of businesses, rather than individuals. Established in 2010, to date it has granted loans of almost £902 million.

As an investor you can choose from three types of investing methods:

1) Bid: You can review every new loan request listed on the marketplace and simply choose which one you would like to invest in.

2) Buy: Investors can trade existing loans with each other. However, investors selling their loans will be charged a 0.25% fee on their loans.

3) Autobid & buy If your unsure how to invest in P2P or don’t have the time to dig deep into the options, you can simply choose the ‘autobid’ option. This automatically uses any available funds in your account to bid on business loan requests and buys parts of existing loads from other Funding Circle investors. It will bid at fixed interest rates for new loan requests.

The autobid system will spread your money to both of the above for you - an actual offered returns are 4.8% for Conservative scheme and 7.2% Balanced schema (after fees and bad debts). This value of return is variable (no fixed rate) and it’s also influenced by your personal setting.

| Key point | Description |

|---|---|

| Estimated return | 4.8% (Conservative), 7.2% (Balanced) |

| Investment terms: | From six months to five years |

| Fee | 1% of received monthly repayments |

| Min/max lent amount | £1000/unlimited |

| Loan amount (individuals in the UK) | None |

| Loan amount (businesses in the UK) | £5,000 to £1 million |

| Lenders | over 75,000 (active) |

| Money lent to date | £3bn |

| Provision fund | None |

Interesting facts

The U.K. government do lend on the partial market and lend approximately 10% to the majority of loans through Funding Circle for the British Business Bank program. This programme provides its financial support to smaller UK businesses with turnover of less than £75m.

Cashback bonus from Funding Circle

Funding Circle does not offer any cashback bonus at this moment.

Advantages

| Relatively high interest rate with variable investing term |

| Minimum lendind amount is £10 |

| Advantage of using Autobid & buy system |

| For immediate access to money you can sell your loans to other lenders |

| Smallest fee of the three listed here for selling on your investment position (0.25%) |

Disadvantages

| According to experienced P2P users, the credit rating system is not as good as Zopa's (due to a series of bad debts with borrowers who initially had a good credit rating |

| They have no provision fund |

| Savings are not protected by the FSCS compensation scheme |

Bottom line

Even though today’s savings accounts do not offer as attractive returns as before, this article has highlighted other options available to those looking to get more from their cash and ready to try something a little different. P2P investing is a massively expanding market because people realise the possibility of high returns (albeit with a certain level of unprotected risk involved).

If this article has piqued your interest in P2P, don’t forget that here I have only focused on the main players in the UK. Being the biggest and oldest doesn’t always mean the best. There are several dozen of peer-to-peer lending providers in the UK to choose from with new ones constantly starting up.

In fact, often, the smaller or newer providers offer better returns. ThinCats, for example, claims lenders can earn 6%-13% and the reBuildingSociety state that their average gross yield could be as high as 15.6%.

Remember though, often the higher the potential rewards, the greater the risk.