Binary options - Types of binary options with a practical examples

Different types of binary options offer different returns and different levels of risk. The loss, however, is always predetermined: it is the full deposit of your investment. Some brokers offer various types of binary options that can be traded. We can find a wide range of types of binary options, but some of them (e.g. short term options, long term options) come from a few basic types. Among the three most popular types of options are:

- 1) High/Low options

- 2) Touch options

- 3) Boundary options (also known as range options)

You can also trade a few other types, but these are not as frequently offered. So if you are interested in one of these types you may need to search a bit to find a specific broker that does offer these types of binary options to trade.

- 1) Spread options

- 2) Pair options

- 3) Ladder options

- 4) Option Builder

Brokers also offer the chance to select different expiry times for the types of options that are listed above. There are a very wide range of expiry times available and trades can be executed for anything from 30 to 60 seconds to as long as one month. Although the following are presented as another type of binary option, they are in fact just another classification based upon the time of expiration - all are derived from the High/Low option type. The other most popular ‘types’ of binary options worth mentioning are:

- 1) Short term options

- 2) Long term options

- 3) 60 second binary options

Generally, all types of options can have their duration set according to the preference or strategy of a trader and, of course, according to what your broker offers.

Some sources also erroneously state that ‘vanilla options’ are a type of binary option. A vanilla option is a different investment tool and has very little in common with binary options. Let’s now look at the different type of binary options we’ve mentioned in a bit more detail.

High/Low options

This is the most basic type of binary options offered by all brokers on the market. Also known as Up/Down options or Call/Put options, it is considered to be the most popular option type amongst traders.

Traders are trying to predict the direction of movement (Up/Down) of an underlying asset over a predetermined time interval. All processes are based on a very simple question: “Will the price of the asset (X) traded be higher or lower than its current price after the expiry time (Y)?”

The expiry time for each trade varies, depending on the trader’s preferences and their strategy. The trades should be executed for a very short time period – as little as 60 seconds (so-called ‘60 second binary options’), or as long as one month. The return of a High/Low binary option is indicated in a percentage, which is usually within a range of 60-90% of the deposit.

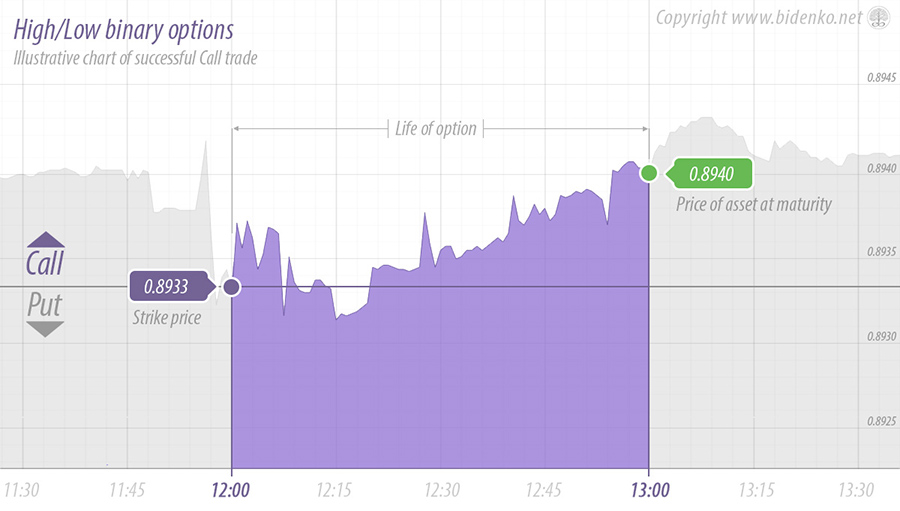

An example how the High/Low options work

Let’s say you choose to trade a currency pair of EUR/GBP, investing $100. You see that currently the payout is 75% with the trade expiring in one hour.

All that you have to do now is to predict whether the rate of EUR/GBP will go up (Call trade) or will go down (Put trade). Let’s say that you expect that EUR will strengthen against the GBP in the following hour, that means the rate will grow. At 1pm you place a Call trade with the currency market valued at 0.8933.

At 2pm the rate of EUR/GBP has risen to 0.8940, meaning your prediction was correct and the full trade is successful. Since the payout on this trade is 75%, you earn $175 (made up of your deposit of $100 plus a reward of $75).

Traders who incorrectly chose a Put trade for this situation would lose their full investment t of $100). In order for Put trade to be successful and Call trade unsuccessful the price at expiry time would have to be lower than a strike price i.e. 0.8933.

Touch options

Different brokers may offer different types of touch options. In this sense, we can come across names, such as One touch/No touch options or Double one touch/Double no touch options. Trading touch options are based on a question which can be formulated as follows: “Will the price of the asset X reach (touch) the upper or bottom predetermined price level prior to its expiration time?”

One thing you have to know before you start trading Touch options is that you cannot setup your own upper or lower price level to trade. These prices level are always created by a broker. You should be careful because you have to predict a more accurate scenario of the movement of the asset than you would need if you were trading a simpler High/Low option.

Touch options – in the standard version offered to traders - average returns of around 70%. Some brokers offer so-called High Yield Touch options, where profit could exceed over 300%, depending on a spread of the target price of the asset.

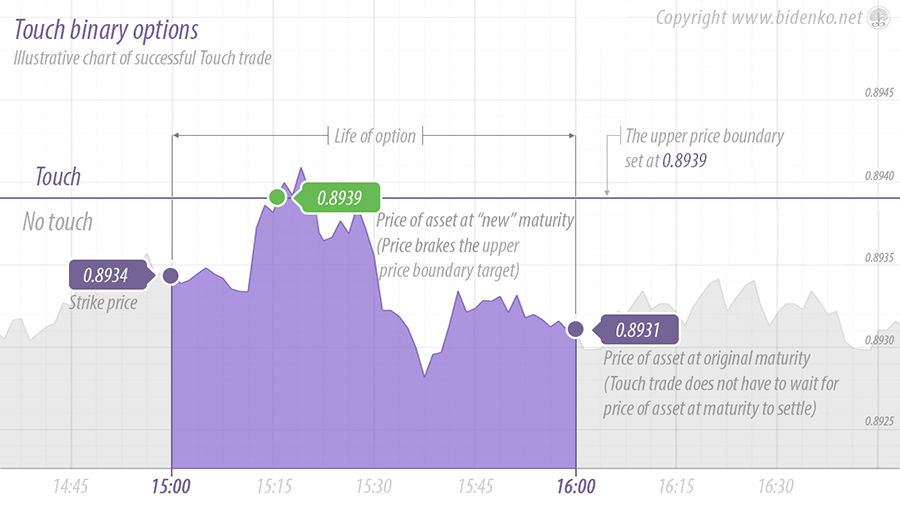

An example of how Touch options work

Touch options have only a few varieties that can be offered by your broker. In this article we cover here only the basic types from which other versions are derived.

For example, let’s imagine that a currency pair of EUR/GBP is selected as an underlying asset while trading at a rate 0.8934. When you select the asset to trade the broker automatically shows the following numbers:

- 1) The upper price boundary of 0.8939;

- 2) Payout as 90% of your deposit;

- 3) Two choices to trade: ‘Touch’ or ‘No Touch’

Let’s say you believe that the asset has the potential to reach this predetermined upper price boundary within an expiry time of one hour. At 3pm you place a ‘Touch’ order with a deposit of $100 USD.

As you can see in the attached image, in this example the price of currency pair of EUR/GBP breaks the price level of 0.8939 a very short time period after placing the Touch trade. That is the best signal for you that your trade is successful and you will get a payout of $190 (your deposit $100 plus a reward $90) after the option expires.

And even though it doesn't matter that the price is lower (0.8931) than the strike price at its expiration at 4pm, the key factor of a successful Touch trade is that the price broke the price level at expiration.

Boundary options (also known as a ‘Range options’)

This type of option is known as both a Boundary options or a Range options. In Boundary options traders speculate whether the price of the underlying asset will stay IN a predetermined range during the entire life of the trade or OUT of this range.

Boundary options generally have higher returns than most commonly traded High/Low binary options, and can have up to 100% returns. It also presents a suitable opportunity for trading in flat markets when prices stay relatively stale and we can't expect any big swings.

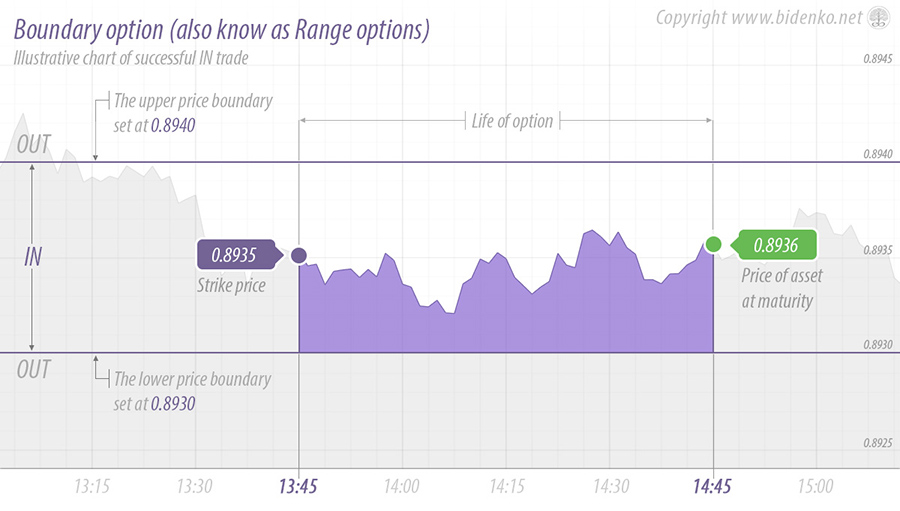

An example of how a Boundary option works

Using the below illustration for our example, we can see the currency pair EUR/GBP is flat on the market and the broker offers an attractive payout at 95% that will expire at 2:45pm. Let’s say for our example you choose to trade this as a Range option after seeing the price range offered (always created by the broker).

- 1) 0.8940: the top price boundary

- 2) 0.8930: the bottom price boundary

The current price of the asset 0.8935 is placed in the middle of the price range demarcated by top and bottom price levels. Together with the price range you can see two possibilities to trade: IN or OUT.

At 1:45pm you put $100 USD deposit to trade IN when EUR/GBP is trading at 0.8935. During the next hour the underlying asset stays relatively flat and doesn’t leave the price range. Since the price stays within the specified range you earn $195 USD on IN trade within an hour (your deposit $100 plus a reward $95).

Spread option

Spread options are based on Touch options. Traders are trying to predict whether the price of an underlying asset will be above or below the price boundary level offered by the broker. However, this type of option has an increased difficulty because the price has to stay above or below at expiry time depending on the selected type of the trade ‘ABOVE’ or ‘BELOW’. The space between the starting price and the price boundary is called the ‘spread’.

Thanks to the increased difficulty, however, there is also a higher profit reward, up to 100% of the deposit.

Pair options

Pair options are a relatively new type of binary options. They are becoming increasingly common and seen as a welcome and innovative way to trade binary options.

Essentially, one can say that it doesn't matter whether the markets are falling down or rising up because Pair options are based on comparing the relative performance of two different assets from one sector. The trader will get a reward if they correctly predict which asset within a given asset-pair will achieve a better performance at the end of the expiry period.

For example, a trader can trade commodities such as oil vs. gold; indices such as the S&P 500 vs. the Nasdaq; or stocks such as a Google vs. Facebook pair; as well as many other different kind of pairs.

Ladder options

Ladder options are quite different from any other type of binary options. This is one of the innovative types of options when traders are pushed to think more carefully about their trades. As with previous types of binary options, every broker who offers these options handles them a bit differently. So, in order to cover the widest spectrum, let’s keep to the basic idea of ladder options.

Ladder options are designed to look like the shape of real ladder with rungs. The rungs represent predetermined price levels at equal distances from each other that a trader gets for each trade. Generally, there are five or six price limits (the exact number could vary depend on the broker) and the strike price could be placed on the top side, on the bottom side or in the middle of the ladder option.

To make a successful trade, the price of traded asset needs to break each price level of the ladder that you choose. If you are correct, then ladder trading can be very profitable, because you can earn over 1,000% profit per single trade. Yes, to confirm that in words: one thousand per cent!

Ladder options allow you to have partial wins and losses. For example, if you achieve only two-thirds of your Ladder trade (that means to reach two price levels out of three), you can still receive a partial profit. Additionally, the price should be lower at expiration then reached on the rungs. The key factor is if these rungs were broken before the option expired.

This type of binary option is for advanced traders and it will probably take a longer time to learn how to be successful and fully profitable while trading these.

Option builder

Many brokers offer a feature, or type of option, on their platform that is called the Option builder and it's based on the classic High/Low options.

Generally, this feature is classified as unsuitable for beginners but don't ask me why. The fact is that this a nice way for beginners to start trading binary options and it partly reduces the risk of loss thanks to its so-called Insurance Rate or Risk Level. In contrary to classic High/Low options, the trader has to setup a few more options before placing each single trade, such as: asset to trade, amount to be invested, expiry time and insurance rate.

The key point to the option builder, which makes this type a bit different to others, is the afore-mentioned option insurance rate. For example, suppose that your broker is offering 100% profit on a selected asset. If you place a trade without the use of the insurance rate, you will lose full deposit if you go wrong. But if you insure your deposit at (for example at 50%) you have a potential profit of 50%. Simply put, what you remove from the potential profit will be moved to the insurance rate. In this case, you invested $100, so that with a successful trade your payout is $150. However, if you are wrong, you will get back your insurance rate (in this example $50).

Keep in mind that the higher the profit is the lower the insurance rate is (and vice-versa).

Short term options

Most often classified as Short term options, these are options which can be executed in a very short time, for example: 30 seconds, 60 seconds, two minutes or five minutes expiry times. If your broker offers to trade ‘Short term options’ it will probably be based on High/Low options.

To trade High/Low options over short expiry times makes this investment tool an extremely risky proposition.

Long term options

On the other side of the fence you can trade options with expiry times over one day, such as: one day, one week or even one month options. In these much fairer time frames it is a bit easier to predict the movement or direction of a market, but it not so attractive for new traders with no trading background. One similarity with ‘Short term options’ is that if your broker offers to trade ‘Long term options’ it will probably be based on High/Low options.

Generally, this type of option is not advertised as prominently as a ‘Short term option’ or even a ‘60 second option’ because it isn’t as attractive for brokers or beginners.

60 seconds binary option

The trading of 60 second binary options (referring to High/Low options) is such a distinct element of binary options that it should be covered in a separate chapter. Why is this? The contrast of fortunes in 60 second trading is significant. The fact you can lose your full deposit in every single trade while also standing to bring in an reward of 75% makes this investment tool extremely risky (and also extremely profitable for brokers).

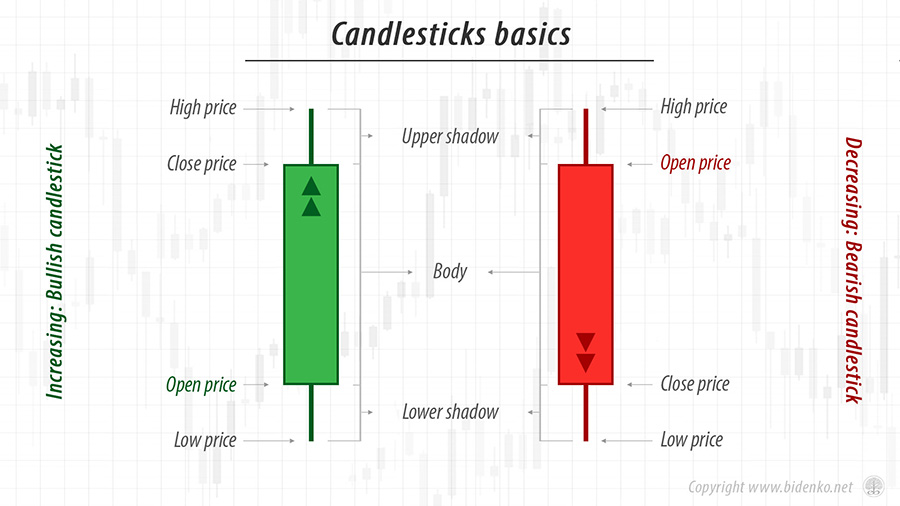

The 60 second time-frame for each trade is a key factor as to why binary options are too risky. If you have not had any experience with trading, it will be bit harder for you to imagine how a one minute chart looks in real-time. For an even better understanding of this, see the above picture of a one minute candlesticks chart for the currency pair of EUR/GBP. Each candlestick in the chart represents one minute of the price development (for a better understanding of how to read the chart, see the basic infographic on candlesticks below).

As you can see, the one minute's chart is consistently moving up and down (even in the moments where it is demonstrating a general upward trend. For long term investing the upward trend of market could be a positive signal to trade, however trading within such a short time period (such us 60 or 30 seconds) makes it very difficult to predict the movement of the price. In fact, trading based on a 60 seconds time-frame is more similar to betting on roulette and betting on red or black than trading. I wouldn’t be afraid to say your chance to win is fifty-fifty.

One might expect that in proportion to the risk the rewards will grow. No! Rewards are absolutely on the standard level of around 75%, or if you're lucky up to 95%. In spite of this, the 60 seconds binary option is the most popular version of all binary options on the market.

The bottom line

Before you decide to trade any type of binary options you should be aware of the general risks which accompany binary options. You can start with the next article that follows and that covers advantages and disadvantages of binary option. In any case, to start using binary options your first step should be to open a demo account to get started and familiarise yourself with each type and variation that exist and find the right one for you.